Rmd calculation for 2021

For those who turned 70 12 before July 1 2019 the first RMD remains at age 70 12. RStudio is a set of integrated tools designed to help you be more productive with R.

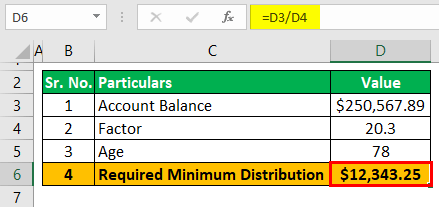

Required Minimum Distribution Calculator Estimate Minimum Amount

This calculator helps people figure out their required minimum distribution RMD to help them in.

. Form 8915-F replaces Form 8915-E. RMD Life Expectancy Calculation Method A required minimum distribution RMD must be calculated for you each year using a divisor from one of two life expectancy tables depending upon. The SECURE Act has raised the RMD age from 70 ½ to 72 for most retirees.

If you turn age 72 or retire and youre already age 72 or over or were age 70½ or older on December 31 2019 in the first year for which you are required to take RMD you have two choices. 2022 Retirement RMD Calculator Important. She then reduces that figure one year for each subsequent distribution year 2020 2021 and 2022 to arrive at 111 instead of 97 under the old tables.

Published Mon Mar 1 2021 800 AM EST Updated Wed Mar 24 2021 1223 PM EDT. The amount changes each year according to your age. Now in 2022 it is up to 182k.

Say you have 300000 in an IRA and use 100000 to buy an immediate annuity. Retirement planners tax practitioners and publications of the Internal Revenue Service IRS often use the phrase. These proposed regulations make a minor modification to the rules to clarify the calculation of the total future expected payments and the total value being annuitized.

The Uniform Lifetime Table also called Table III shows the distribution period thats the divisor you use to calculate your RMD based on your 12312021 balance. Next find your age on the IRS. It allowed those affected by the coronavirus situation a hardship distribution of up to 100000.

And in 2021 it grew to 176k. You can take your first withdrawal the amount required for the first year in that year eg 2021. Required minimum distributions RMDs are amounts that US.

You pay surcharges on Medicare. GRANDMAS OWN IRA. The 100000 is turned into a stream of payments and is excluded from the RMD calculationYou still would have to.

Then you would have to take your. For the 2021 distribution calendar year taxpayers must apply the existing. The official version of IRS Publication 590-B for the 2021 tax year includes the new life expectancy tables used to calculate RMDs from retirement accounts.

Ava is 17 when she inherits the two IRAs in 2021. Individuals who attained age 70 12 in 2019 or earlier and individuals who attain age 72 in 2021 or later. Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually.

For instance if you turn 72 in 2022 you have until April 1 2023 to take your first RMD. Generally the previous year-end balance. If the Single Life Table had remained unchanged his divisor for 2022 would have been 285 which was what SL.

Under the new rules you can use a rate no more than the greater of. Terms of the plan govern. The SECURE Act of 2019 changed the age that RMDs must begin.

While the calculation of the RMD is straightforward there are a number. Rollover to another qualified plan or IRA. You must take your first RMD for 2021 by April 1 2022 with subsequent RMDs on December 31st annually thereafter.

Amended 544974-1 is proposed to apply for taxable years beginning on or after January 1 2022. You reached age 72 on July 1 2021. Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915 for that years.

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. If you would normally have taken an RMD on Dec. Or you can wait and take it in the next year.

However retirees born before July 1 1949 will still have an annual RMD starting in 2021. 401a Investment Options. In 2021 with the divisor reduced by a year from 305 to 295 SL.

By completing the Plan 3 RMD form yourself you can choose to have the money withdrawn differently. A plan may require you to begin receiving distributions by April 1 of the year after you reach age 70½ age 72 if born after June 30 1949 even if you have not retired. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

On March 27 2020 President Trump signed a 2 trillion coronavirus emergency stimulus bill. If you were born on or after 711949 your first RMD will be for the year you turn 72. Under the old rules you had to use 120 of the federal mid-term rate 152 for December of 2021.

AVAS RMD REQUIREMENTS IRA 1. Under the new rules you. What I want to do is take an RMD in Dec 2018 leave the balance in the plan until April.

Regular price 1 2021-Present 3 piece Polaris General XP Hood GraphicDecal. How much do I have to withdraw each year. 31 2020 you must have taken one by Dec.

Beginning on January 1 2022 RMD calculations performed by Oppenheimer Co. If you were born before 711949 the age remains 70 12. Why is this important.

All subsequent RMD withdrawals must be taken by Dec. 1 2019 Polaris Rzr Xp 4 Turbo S Graphics Wrap Kit High Coverage 2500 MacBook Air 13-inch - M1 Chip 8GB Ram 256gb SSD - Gold - Apple Aug 10 2021 AVS branched out and began manufacturing automotive protection and appearance enhancing accessories 030 Piston Polaris. Doing the Calculation.

Tax law requires one to withdraw annually from traditional IRAs and employer-sponsored retirement plansIn the Internal Revenue Code itself the precise term is minimum required distribution. Since you never recognize it as income it never hits your top line on the 1040 and thus you pay less in taxes. For those individuals the first RMD moved from age 70 12 to age 72.

New IRS rules complicate the calculation of required minimum distributions for those who. You donate your Required Minimum Distribution RMD rather than recognize it as income. It includes a console syntax-highlighting editor that supports direct code execution and a variety of robust tools for plotting viewing history debugging and managing your workspace.

Thats because the calculation requires the dollar amount of the contribution is calculated based on your income after the maximum contribution is deducted from that compensation. Start by calculating how much you had in all your tax-deferred accounts as of December 31 of the previous year.

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distributions For Retirement Morgan Stanley

Required Minimum Distributions Rmds Youtube

Required Minimum Distribution Calculator Estimate Minimum Amount

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Required Minimum Distribution Calculator

Rmd Calculator Required Minimum Distributions Calculator

What Is A Required Minimum Distribution Taylor Hoffman

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type

Calculating Required Minimum Distributions

Rmd Table Rules Requirements By Account Type

Secure Act S Increase In Rmd To Age 72 May Lead To Avoidance Of Net Investment Income Tax Hall Benefits Law

Where Are Those New Rmd Tables For 2022

Required Minimum Distributions Update 2021 Fcmm Benefits Retirement

Required Minimum Distribution Rules Sensible Money